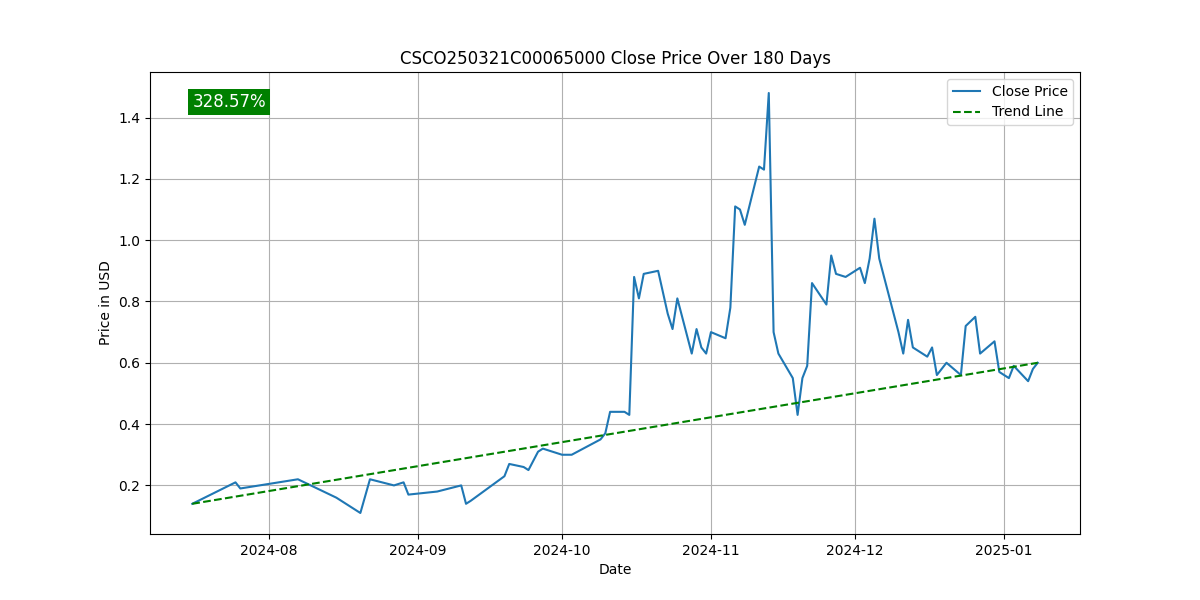

In the dynamic world of options trading, the Cisco March 2025 call option (CSCO250321C00065000) is drawing attention with its impressive performance. The contract, set at a strike price of $65 and expiring on March 21, 2025, has delivered a staggering 328.57% return over the past six months. Currently trading at $0.60, the option's compelling bid-ask spread ($0.57/$0.64) is a beacon for traders seeking lucrative opportunities in tech equities.

This remarkable growth trajectory is underscored by an open interest figure of 15,545, reflecting strong market confidence in the tech giant's outlook. With an implied volatility of 23.29%, the option presents an enticing risk-reward proposition for those willing to bet on Cisco's upward momentum. The robust volume of 775 contracts traded recently further highlights burgeoning trader interest, solidifying this option's status as a must-watch.

For traders with an appetite for high-risk, high-reward strategies, this Cisco call option could be a golden ticket. As the expiration approaches, now is the perfect time to delve into this enticing opportunity and capitalize on its significant return potential. Explore and seize the moment before the next big market shift.