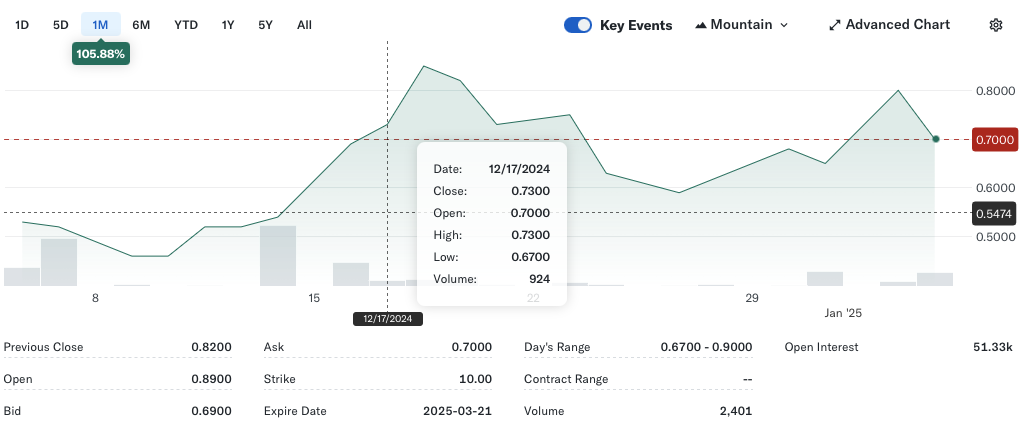

The Ford put option F250321P00010000 has surged by 34% in the past month, reflecting heightened interest from traders seeking downside protection. Its last traded price sits at 0.69, with a tight bid-ask spread of 0.66–0.68 and an implied volatility of about 35.7%. Despite a slight drop of 1.43% in the most recent session, strong volume and open interest figures suggest that investors are actively positioning themselves ahead of the March 2025 expiration.

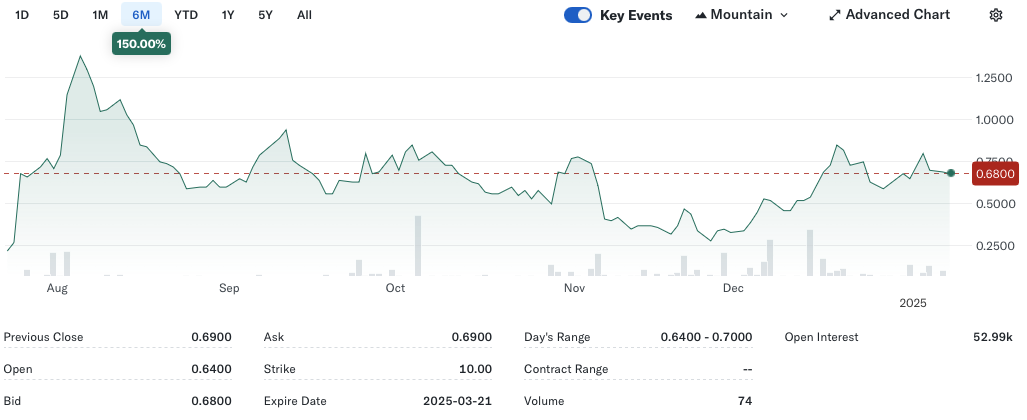

Looking further back, this in-the-money put option has soared by 150% over the past six months—an impressive long-term gain that underscores persistent bearish sentiment or hedging strategies around Ford’s stock. With over 52,000 contracts open, the market signals a sustained conviction that downside risks may remain relevant for Ford investors in the coming months.